Chinese Bitcoin Trader Commits Suicide after Losing 2,000 BTC on 100x Leverage Bet

A bitcoin trader dealing with clients' investments has reportedly committed suicide over a high-risk margin bet. | Source: Shuttersock

12/06/2019

By CCN Markets: A Chinese Bitcoin trader has allegedly committed suicide after he lost investor’s money in a highly leveraged trade position. According to 8btc, Hui Yi lost 2,000 Bitcoins after he entered a short position which was liquidated after it went in the opposite direction. The trader, who was the co-founder and CEO of cryptocurrency market analysis platform BTE.TOP, died on June 5.

At current prices, Yi lost nearly $16 million in one position. Yi had leveraged his position by 100 times and thereby magnifying his losses.

Yi’s death was revealed by an ex-partner as speculation was raised that the 2,000 Bitcoins had been embezzled from clients. Speculation has also been rife that Yi could have faked his death to avoid paying back his clients.

WHY IS LEVERAGED BITCOIN TRADING SO APPEALING?

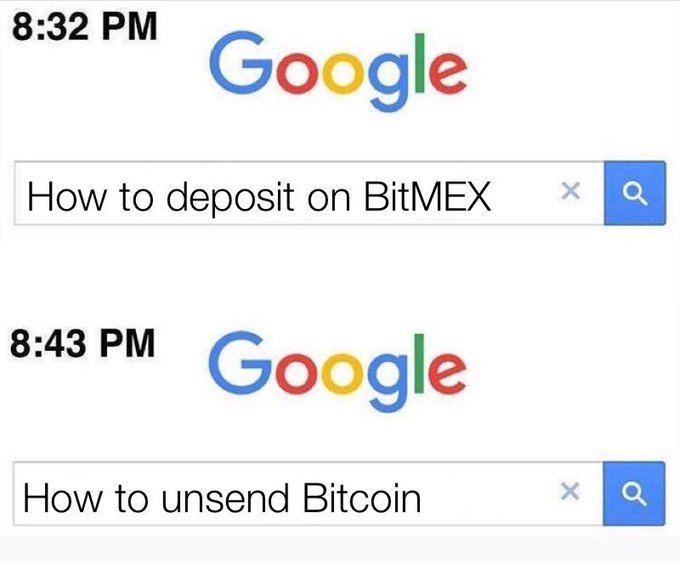

It is easy to fall for the leveraged trading trap. This is because the size of a position is greatly increased using ‘someone else’s money’. In other words, a broker or an exchange lends you money to trade. But while it can be highly profitable if a trade goes your way, the losses are greatly magnified if the opposite happens.

In Yi’s case, he was expecting Bitcoin’s price to fall and so allegedly entered a short position of 2,000 BTC. By employing 100x leverage, Yi was effectively trading with 200,000 Bitcoins! Consequently, Bitcoin only needed to go up 1 percent from the entry price for Yi to lose all the funds.

ANTICIPATED BITCOIN DROP FAILS TO MATERIALIZE

Social media messages indicate that on May 31, Yi had been expecting Bitcoin to fall to $7,000. This might have been informed by the fact that Yi was expecting a retracement. Hours earlier Bitcoin had reached a yearly high of slightly above $8,900 where it hit a strong resistance.

From the charts, Yi was most likely expecting support at the $7,000 level. Instead, Bitcoin touched the $8,300 mark and bounced back to $8,700 in the days that followed rather than continuing the downward trend as Yi had anticipated.

Bitcoin has since fallen below $8,000.

HOW COMMON IS LEVERAGED TRADING AMONG CRYPTO TRADERS?

Highly leveraged positions are common in the forex markets where fiat currencies rarely move by a whole percentage point in a single day. But in the cryptocurrency markets where the tradeable assets are highly volatile, leveraged trading is only starting to take root.

Previously margin trading in crypto was primarily associated with Bitcoin derivatives market giant BitMex. But recently cryptocurrency exchanges have started offering margin trading or are on the verge of doing so. Towards the end of last month, Binance cryptocurrency exchange announced it was testing margin trading. The trial phase is still on.

And late last month, U.S.-based cryptocurrency exchange Coinbase announced that it was considering introducing margin trading.

This was revealed by Coinbase CEO Brian Armstrong during the firm’s ‘Ask Me Anything’ on YouTube.

No comments:

Post a Comment